Who Controls The Media?

Out of the Shadows of History with Daniel Sheehan

How did the political and financial world get to be in the state that it is in today? As we will soon see, it was not by accident. Daniel Sheehan reveals many tell-tale snippets of history that have intentionally been left out of the public narrative which tell of the establishment of a financial cabal and their puppet governments within the United States and the rest of the world. What we learn, is that the forces which have been running our planet are becoming obsolete and it is up to us to make the change.

Challenge the status quo by seeking your own truth. Gaia is completely ad-free and 100% member supported. Explore perspectives you won’t find in the mainstream on some of life’s biggest mysteries; stream thousands of videos to help you on your own journey of discovery with Gaia.

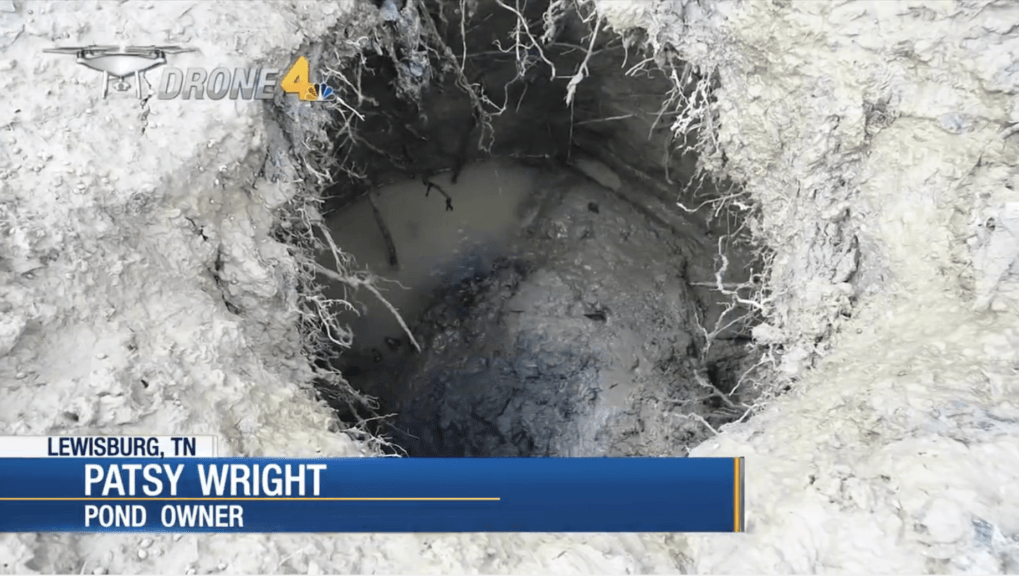

Mysterious Object Falls from Sky, Drains 100-Year-Old Pond

A woman living in a rural Tennessee town claims she saw something fall from the sky into a pond in her backyard, finding the pond was suddenly drained of its water. That resident, Patsy Wright, dismissed the idea that the drainage might be due to a sinkhole, as she says she saw something coming from the sky into the water, creating large waves, before the pond disappeared entirely.

Wright reported the story to her local Nashville NBC affiliate, which ran a report that included drone footage of the depleted pond she says had been there for over a century.

“When I seen them waves go up like it did (sic) and then they come back down. And I heard the splash. I mean it was a big splash,” Wright said. “I walked down here with my dog and sure as the world, no water. It was gone.”

According to reports, it was difficult to tell what the object was, due to the depth of the hole. It’s also unclear what happened to the water, though it’s assumed it was absorbed into the water table below, after the pond was struck.

“I know something hit it, because I heard it. I thought, I’m not imagining nothing. It’s there.”

Some online were quick to connect the drainage of Wright’s pond with a similar account from the CIA-employed remote viewer Ingo Swann, who in his autobiography recounts being taken to see a triangular UFO, which subsequently drained a lake of its water.

His account describes being flown to an undisclosed location in the north (possibly Alaska or northern Canada) where he says, “That was my last sight of the triangular thing, but in that last moment I could see the water of the lake surging upward – like a waterfall going upward, as if being sucked in to the “machine!”

This might seem farfetched, however there have been other bizarre accounts of lakes, ponds, and other small bodies of water experiencing sudden drainage unable to be explained by geologists or other professionals. An instance like this occurred on a farm in Utah in 2014, where a bizarre crater appeared in a reservoir.

When interviewed about the strange cavity the farmer described it by saying, “My heck, I guess that’s Martian art!”

Experts from the Utah Geological Survey were unable to explain the phenomenon.

Often unexpected holes like these are attributed to sinkholes – a sudden collapse of the ground caused by the erosion of underlying rock layers typically consisting of limestone. It’s unclear whether a sinkhole could have been the culprit in the latest incident, but if Wright actually witnessed and heard something fall from the sky, a sinkhole could be easily ruled out.

For more anomalies falling from the sky check out Out of the Blue from Arthur C. Clarke’s Mysterious World: